What’s Moving the Market?

Commentary from Richard Fleuriot - Managing Director & Head of Advice at F&A (08 April 2024)

Hi All,

I am sure you are all awash with the noisy news around current events. Be it Trump with sanctions or more locally, the ANC with VAT, we are once again facing our first unprecedented event since our last one, tongue-in-cheek intended. As I have shared several times over, news is noise, and noise distracts from long-term focus. There are always challenges, and amongst these pressure pinches, it is important to remember that risk and uncertainty also brings opportunity.

It will be incredibly difficult to predict the outcomes of the USA policy of America first, and the sanctions imposed globally. I would expect volatility. This will add to the noise. Closer to home, I am personally positive around the noise and backlash the ANC is experiencing. Their free lunch is over. I would expect the pressure to heighten on them and would be unsurprised if they moved to more desperate action. I would expect a good deal of noise over this elected term, big trees fall hard.

This short video from our investment partners PortfolioMetrix touches on the basics around asset allocation, diversification and timing the market. It aims to answer the question you may have, including, should I make meaningful adjustments to my approach?

The simple answer to your question around major interjection to strategy is no, you shouldn’t have a knee-jerk reaction. You see, the assumption is that your investment may have been idle until now, and that it could be our joint responsibility to do something about that. That is plainly untrue.

First and most importantly the strategies we run are intentionally active, and more importantly, designed for these impact events, the types of which we cannot predict, either by its nature, timing, or implication. Put differently, we know impact is coming and so we position for this. We are humbly always risk-adjusted, holding multiple asset classes, baking in multiple teams per asset class, resulting in smart diversification. This does not mean we will get everything right, that is impossible. Our aim is to instead get less wrong. There are elements of your portfolio which will perform positively during these tough periods. This is by design. Secondly, this active nature of our strategies means tweaks and adjustments happen in the background throughout. Be it shifts in and out of assorted opportunities, or risks, through to larger tactical adjustments to weighting of holdings / asset allocation and more.

Practically, this means we will feel a degree of the impact present in the markets, but by design, far less than that of our and your colleagues. More to the point, this is built into the long-term journey we travel with you on; we know these moments are coming and have modelled these risk pinches into our targeted outcomes. A successful outcome to this all would be for these tough and uncertain periods to not tangibly alter the targeted outcome of your strategy.

Time will tell once again if we can achieve this, but I like our odds, I believe in our strategy and I back our appointed teams. Our approach has served us well throughout local and international challenges, including wars and pandemics.

It may not seem it, but these are the periods where the greatest opportunities can present.

I will keep you posted on whether any meaningful adjustments to your strategies are to be made. In the meantime, if you are struggling to cope with these events and its implications for your setup, please give us a shout, and let’s sit down and have a good chat about it all!

Sending love

Richard and the F&A team

A Market Update from Brendan De Jongh - Head of Global Investment Strategy at PMX (08 April 2025)

Liberation Day: The Fall Out, A Long-Term Perspective & PMX Response

Liberation Day Tariff Announcements

Liberation Day Tariffs were announced last week Wednesday, with a universal tariff rate of 10% on all imports and further tariffs of 10-50% on specific countries. The universal rate came into effect yesterday (April 7th), and the specific country rates are due to begin on April 9th. The proposed tariffs will take the US effective tariff rate to its highest level since the 1930s, and crucially, are higher than what Trump promised during his presidential campaign.

Why the Market Fall Out?

Global Equity markets have fallen sharply in response to the announcements. As the below chart from Bloomberg shows, markets have only experienced greater falls over a two-day period twice, once during the Global Financial Crisis and the other occurring during the onset of the COVID-19 pandemic.

It was no secret that Donald Trump intended to impose wide ranging tariffs on trading partners, so what has caused markets to respond in the way they have?

Markets were expecting tariffs to be imposed by President Trump. However, they were caught off-guard by the size and scale of the actual tariffs that were announced. In response, markets have had to completely recalibrate their expectations of future earnings growth, inflation and unemployment, all of which has had a negative impact on asset prices.

Markets are now awaiting how countries respond to these announcements. China has already unveiled retaliatory tariffs, and the EU is expected to respond in the coming weeks. This raises the possibility of a full-scale trade war between the world’s largest economies, and has created a lot of uncertainty across markets.

A Long Term Perspective

Investing, as we well know, is a marathon, not a sprint. And at times like these, it is important to focus on the long-term.

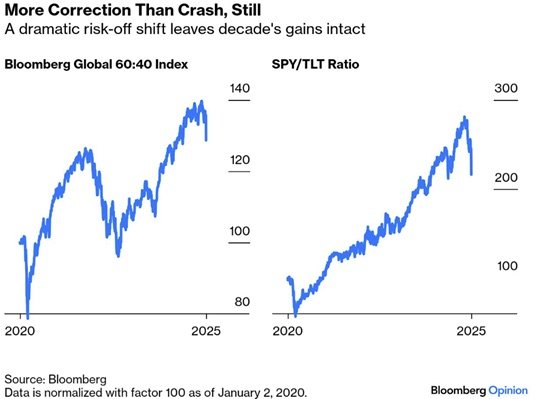

Looking backwards helps provide some perspective. A classic, 60/40 portfolio is still comfortably ahead of the lows of 2020, and equities are still a long way ahead of bonds since the pandemic crash in 2020 (shown by the SPY/TLT ratio below, which displays the relative performance of US Equities over US Government Bonds) – as the below charts show.

Looking forward, the below chart illustrates why it’s crucial to look through the short-term noise and avoid making knee-jerk reactions in your portfolio at times of market stress. Using the same 60/40 portfolio, despite numerous, large scale external shocks such as wars, pandemics and political events, on average, a 60/40 portfolio has risen almost 10% in the subsequent 1 year, and over 20% in the subsequent 3 years following a market shock. Thus, highlighting the importance of remaining invested and staying focused on the long-term.

PortfolioMetrix Response

Periods such as these are exactly the reason diversification in portfolios is so important. All asset classes respond differently to macro-related shocks, and while equity markets have made headlines given the size of the falls, Government Bonds have risen over the same period showing their value as a defensive asset class during times of stress. Equivalently, equity markets that are less exposed to global trade risks have fallen less.

So, instead of trying to time markets, and shift portfolios in response to macro events, we remain focused on understanding the risks in portfolios, ensuring portfolios are not overexposed to single risk factors, and seeking to diversify away exposures that we do not believe are rewarded over the long-term.

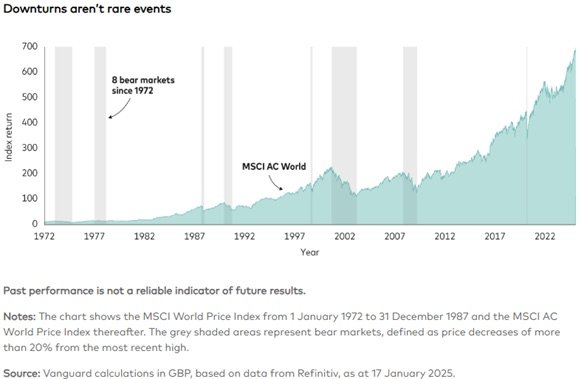

Remember, stay diversified, stay invested and avoid making impulsive decisions based on short-term noise. As the below chart shows, over the very long-term, despite several market drawdowns, equities continue to deliver competitive compelling returns for investors.

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog