October 2024 Update

F&A Monthly Update | OCTOBER 2024

We hope this message finds you in good spirits. As part of our ongoing commitment to keeping you in the loop, it's time for our monthly update! These updates provide a quick glimpse into market insights from PortfolioMetrix, giving you an overview of where your investments are headed. Here's your October 2024 update!

Sending love

Richard and the F&A team

October 2024 Update

This month's piece is compiled by Brendan de Jongh, SA Head of Research - PortfolioMetrix.

Fixed Income, Diversified Outcomes

LOOKING BACKWARDS

Over the past century, bonds have been steady investments, offering lower returns with lower risk. This has given them the reputation of being reliable preservers of capital in portfolios. However, this isn't always true. In 2021, as economies began blowing away the COVID cobwebs, demand outpaced supply, driving up prices. Then, Russia's invasion of Ukraine stressed commodity supplies like oil and crops, significantly increasing inflation.

Source: FT (October 2024), US inflation and interest rates since 2020

Central banks responded to rampant inflation by quickly raising interest rates. Higher rates caused bond prices to fall, leading to lower returns. Bonds weren't broken; they behaved as expected under the circumstances, though not in a way that preserved capital as investors might have hoped.

WHERE WE STAND NOW

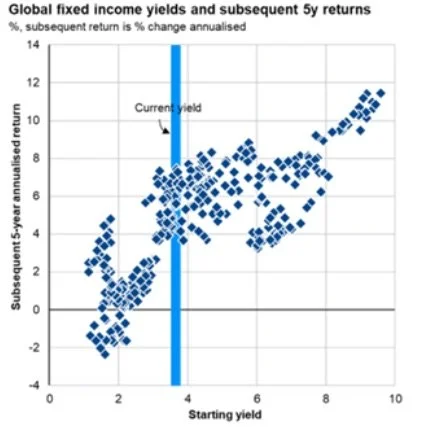

Despite recent turmoil, bonds remain an attractive investment. The traditional advantages of bonds—lower risk, stable returns, and diversification—continue to apply and make them good investments within a multi-asset portfolio. As of end October, the starting yield on the global bond index is higher than recent history, at 3.6%. Based on historic data, we would expect this yield to lead to returns of between 4-8% per annum over the next five years; likely delivered with low risk and adding diversification to portfolios.

Source: JP Morgan Guide To The Markets Q4 2024 (31 October 2024), bond yields and subsequent 5-year returns. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment.

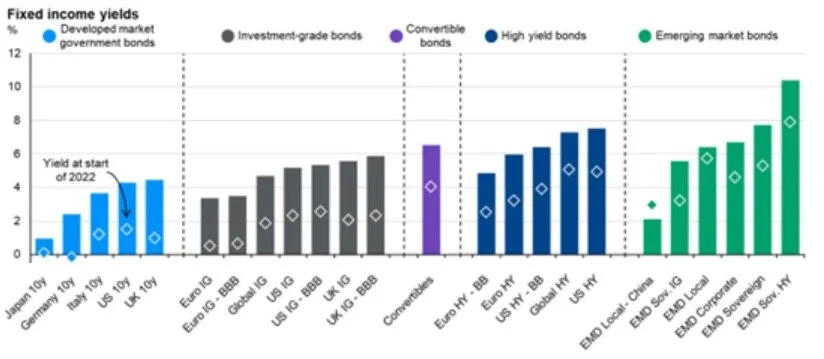

We can also look at the different individual bond asset classes. Currently bonds have a very high yield, mostly around 4-10% and this is high relative to recent history. Investors are generally rewarded for taking higher risk and this is currently the case – yields (and thus expected returns) are highest on emerging market bonds and high yield bonds, which are riskier than government bonds.

Source: JP Morgan Guide To The Markets Q4 2024 (31 October 2024), fixed income yields across different bond asset classes. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment.

Competition for Portfolio Capital

As shown above, spreading your investments across different bonds (diversification), results in higher yields and higher expected returns. We always advocate for diversification within portfolios. Diversifying your portfolio protects you from unexpected risks and could improve returns based on historical data.

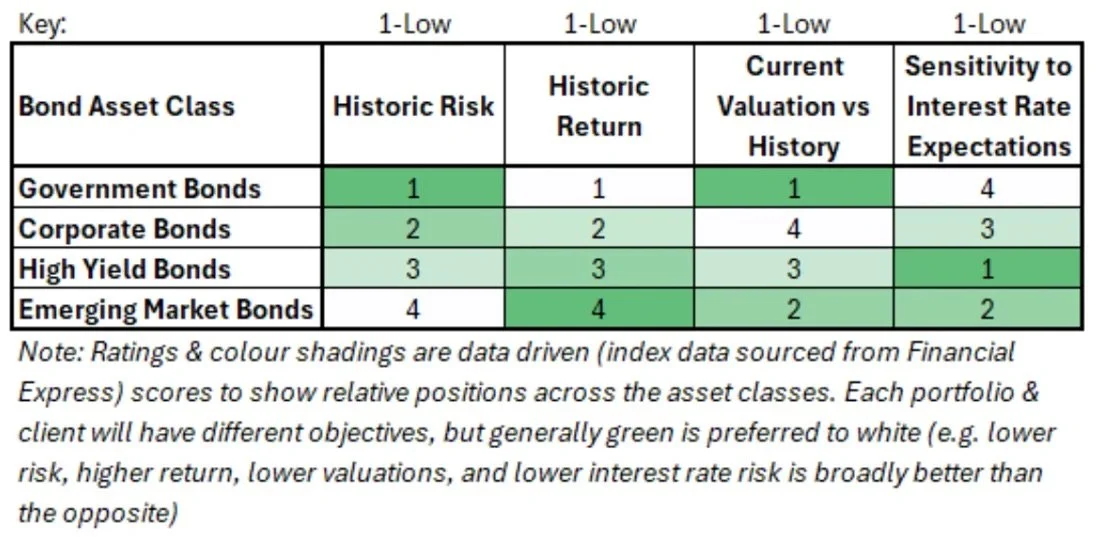

What does this diversification look like within portfolios? Not all bonds are identical, and each bond asset class has different characteristics and risk/reward trade-offs. We believe that blending these within portfolios can maximise their advantages and help diversify against some of their individual drawbacks. Based on risk level, a multi-asset portfolio will include a mix of the following bonds:

Source: Financial Express and PortfolioMetrix. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment.

At PortfolioMetrix, we diversify across asset classes (cash, bonds, equity, real assets) within the client's risk mandate. This diversification helps protect portfolios from unexpected financial shocks and supports clients in staying on track with their financial plans to achieve their future goals.

Global Update

Provides an overview of current global market dynamics and essential insights.

Local Update

Provides an overview of current local market dynamics and essential insights,

Performance Links

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog