Q2 2024 Update & Fund Commentary

Our Quarterly Commentary aims to carry and share the bulk of our reflections and analysis of the previous quarter. To help cater to your preferences, we've provided various avenues for navigating through an entire Quarter's worth of news and data.

You can view the full recorded feedback session (± 1 hour 20 minutes) here for a deep dive into the last quarter

The presentation slides are also linked below

And for the real meat, scroll a little further to find the full detailed commentaries on both South African (45 pages) and Global markets (13 pages) and portfolios

To catch up on past insights, please visit our blog for a recap of previous commentaries.

And, of course, if you'd like to engage in further discussion, please don't hesitate to reach out. We're always here and ready to chat.

Sending love to you and yours,

Richard and the F&A Team

This piece was compiled by Brendan de Jongh, SA Head of Research at PortfolioMetrix.

The second quarter largely reflected the return characteristics of the first quarter, although with diminished intensity. Equities outperformed bonds, while real assets, such as listed infrastructure and real estate, continued to disappoint. The quarter began on a challenging note, with a sharp rise in Treasury yields in April negatively impacting most major asset classes. However, as the quarter progressed, stronger-than-expected economic growth and signs of disinflation provided solid support for the markets. This positive shift was further bolstered by impressive earnings results from major companies benefiting from the burgeoning Artificial Intelligence theme, which helped sustain market momentum, albeit in a concentrated manner. Credit spreads have moved in sympathy with the stock market rally and investors that moved down the risk curve have been commensurately rewarded.

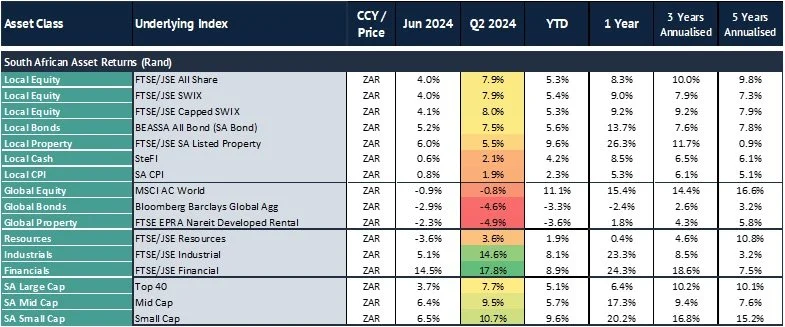

FIVE YEAR ASSET CLASS RETURNS MATRIX (in Rand terms)

The PortfolioMetrix team has recorded their feedback session, discussing a few key aspects from this last quarter. We trust you'll enjoy and find this summarised commentary valuable.

The Quarterly Feedback Session & Presentation Slides are linked below:

For the full Local & Global Quarterly Fund Commentaries, please click the links below.

Local Fund Commentary

Provides a commentary on the past quarter, its events and their impacts; as well as more intimate commentary on each moving part within your portfolios.

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog