Q3 2023 Update & Fund Commentary

Our Quarterly Commentary aims to carry and share the bulk of our reflections and analysis of the previous quarter. To help cater to your preferences, we've provided various avenues for navigating through an entire Quarter's worth of news and data.

Opt for a quick overview with a short video commentary (± 10 min)

If you're looking for a deeper dive, the full recorded feedback session (± 1 hour), and presentation slides are also linked below.

And for the real meat, scroll a little further to find the full detailed commentaries on both South African (43 pages) and Global markets (15 pages) and portfolios

To catch up on past insights, please visit our blog for a recap of previous commentaries.

And, of course, if you'd like to engage in further discussion, please don't hesitate to reach out. We're always here and ready to chat.

Sending love to you and yours,

Richard and the F&A Team

This piece was compiled by Brendan de Jongh, SA Head of Research at PortfolioMetrix.

Over the past quarter, we have observed a notable tightening of financial conditions in the United States, driven by an upward trajectory in cash rates and a simultaneous rise in long bond yields – this is precisely what the US Federal Reserve intends to achieve. This development has however contributed to a broader global risk-off sentiment, prompting investors to reassess their portfolios and adopt a more cautious approach amid the uncertainties.

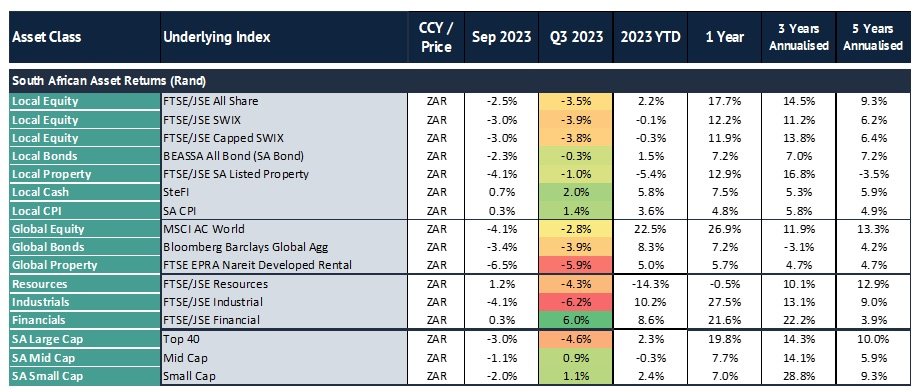

Within this risk-off environment the rand held steady over the quarter, other South African assets, barring cash, witnessed negative returns. Notably, the quarter also saw a significant surge in oil prices, with a 27% increase which poses inflationary risks to the upside.

Given the global uncertainty and continued variability in the market we continue to maintain diversification within client portfolios, managing the risks, and aiming for efficient risk-return characteristics. Our view is that markets are providing fresh opportunities to generate diversified returns for clients, something to be optimistic about. I encourage you to explore this further in the commentary attached below.

The tables below summarise the asset class movements over various time frames.

FIVE YEAR ASSET CLASS RETURNS MATRIX (in rand terms)

The PortfolioMetrix team has recorded a short summary video discussing a few key aspects from this last quarter. We trust you'll enjoy and find this summary valuable.

Full Recorded Session & Slide Deck

If you would like to watch the full feedback session, you can do so here. Or you can access the presentation slides here.

For the full Local & Global Quarterly Fund Commentaries, please click the links below.

Local Fund Commentary

Provides a commentary on the past quarter, its events and their impacts; as well as more intimate commentary on each moving part within your portfolios.