August 2024 Update

F&A Monthly Update | AUGUST 2024

We hope this message finds you in good spirits. As part of our ongoing commitment to keeping you in the loop, it's time for our monthly update! These updates provide a quick glimpse into market insights from PortfolioMetrix, giving you an overview of where your investments are headed. Here's your August 2024 update!

Sending love

Richard and the F&A team

August 2024 Update

This month's piece is compiled by Brendan de Jongh, SA Head of Research - PortfolioMetrix.

As we navigate the dynamic world of financial markets, it's important to revisit a critical subject: market volatility. The recent shifts in early August 2024 remind us of the unpredictable nature of markets, influenced by weaker economic data and persistent geopolitical strife.

Understanding Market Volatility

Market volatility is a normal and recurring phenomenon. For instance, the early August dip was influenced by weaker-than-expected job creation and an uptick in the unemployment rate, in the U.S., coupled with erratic earnings reports from major tech companies and weak manufacturing data. Geopolitical uncertainties added to the market's instability during this period.

Though these immediate disruptions are notable, the bigger picture reveals another tale. When we examine the major indices' performance in US Dollars for August, a different narrative, one of resilience, emerges:

S&P 500 (representing US large caps) initially fell by 6.1%, but rebounded to end the month up 2.4%.

Nasdaq (representing US tech stocks) saw a drop of 7.9%, yet closed the month with a 0.7% gain.

Russell 2000 (representing US small caps) experienced a 9.5% decline, but reduced the loss to 1.5% by month’s end.

The Pitfalls of Market Timing

The temptation to react to such volatility by exiting the market can be strong, but history and research consistently show that this approach often leads to missed opportunities and diminished returns. Timing the market—selling during downturns and buying ahead of upturns—is notoriously difficult and seldom successful over the long run.

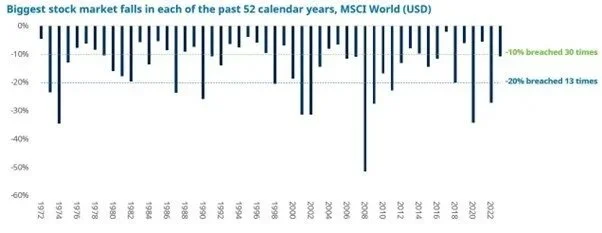

History shows that significant market declines are more common than we might like to think. For example, the MSCI World Index has experienced 10% declines in 30 out of 52 years before 2024, with more substantial 20% falls occurring roughly once every six years. Yet, despite these setbacks, the market has historically delivered strong average annual returns.

Source: Schroders Insights August 2024

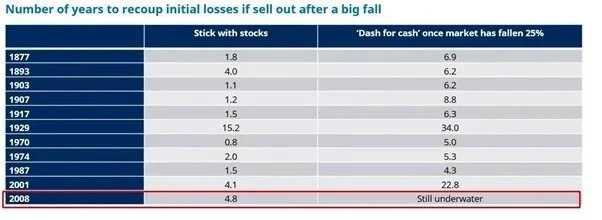

Additionally, data from past financial crises illustrate the long-term consequences of abandoning the market. Investors who shifted to cash during the Great Depression or the 2008 financial crisis found themselves having to wait for decades to break even, whereas those who stayed invested recovered much sooner.

Source: Schroders Insights August 2024

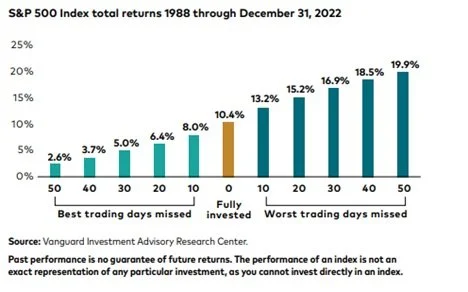

Studies emphasize how crucial it is to stay invested in the market. For instance, an investor fully invested in the S&P 500 from 1988 through 2022 would have seen impressive returns. However, just missing out on the top 10 days during that span would have had a significant impact on your long term returns. This difference highlights the necessity of weathering market ups and downs. Perfectly timing the market is impossible, but staying invested consistently lets you capture overall growth and recoveries, offering a more dependable route to wealth building than trying to hit the market's high points.

Delaying Investments is even worse than poor market timing

A hypothetical case study by Charles Schwab highlights the stark contrast between two investors, Rosie Rotten and Larry Linger, demonstrating the pitfalls of market timing versus procrastination. Rosie Rotten invested $2,000 annually at market peaks, yet still amassed $112,292 over 20 years (2003-2022). This is because her money had the opportunity to grow, benefiting from the power of compounding and market recoveries, despite initial poor timing.

In contrast, Larry Linger kept his funds in cash, waiting for the perfect investment moment that never came. Consequently, his returns were a mere $43,948. This significant gap underscores the importance of being invested rather than procrastinating. Even badly timed investments (buying high and selling low) can yield better returns than not investing at all. Larry missed out on compounding, market rebounds, and bore the high opportunity cost of uninvested cash in addition to the nasty effects of inflation eating away at your purchasing power.

The lesson here is clear: procrastination can be more detrimental than bad market timing. Consistent investment, regardless of market conditions, is crucial.

The full case study can be found here: Does Market Timing Work? | Charles Schwab

Focus on Long-Term Goals

As we continue on our investment journeys, let's emphasize the importance of maintaining a long-term perspective. Stay disciplined on avoiding reactions to short-term market noise and remain focused on our investment goals. Stay reminded that, while volatility is inevitable, it is also a natural part of the market's ebb and flow.

By staying the course and resisting the urge to time the market, we are more likely to achieve our financial aspirations.

If you have any questions, please feel free to reach out and we’ll be happy to help.

Global Update

Provides an overview of current global market dynamics and essential insights.

Local Update

Provides an overview of current local market dynamics and essential insights,

Performance Links

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog