Q3 2024 & September 2024 Update & Fund Commentaries

This piece was compiled by Brendan de Jongh, SA Head of Research at PortfolioMetrix.

This entry includes both the Quarterly Investment Update & Fund Commentary for Q3 2024, and the September 2024 Monthly Update. If you would like to jump ahead to each of these, please click the links below:

The Commencement of the Rate-Cutting Cycle: PortfolioMetrix Thoughts

In September, the Federal Reserve (the Fed) decided to lower interest rates by 0.5%, bringing them down to a range of 4.75%–5.0%. This move follows a period of rapid rate increases and puts the Fed in line with other central banks that have also started to cut rates. By looking at how markets have reacted to rate cuts in the past, we can get a sense of what might happen next. We examine past rate-cutting periods in the US under various economic conditions to understand what kind of returns investors might expect.

What the past tells us of previous rate-cutting cycles

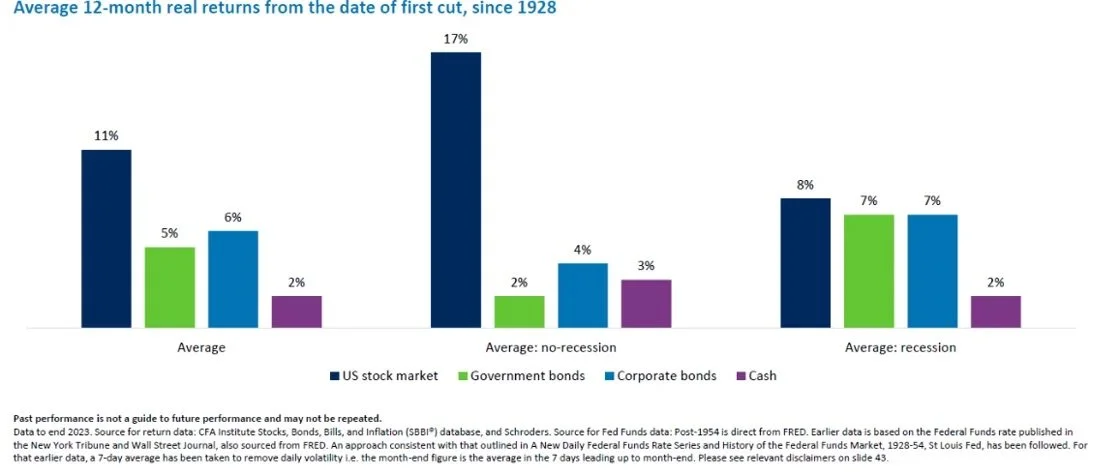

Since 1928, the US has gone through 22 periods where interest rates were cut. In 16 of those times, the country was either already in a recession or entered one within a year after the first rate cut. This suggests that a soft landing, where the economy slows down without falling into a recession, is pretty rare — it’s only happened about 27% of the time. However, the market seems to be expecting just that right now. Historically, when rates are cut and there’s no recession, stocks (which are riskier investments) have done much better than safer investments like bonds. Even if a recession does happen, stocks have still generally performed better than cash and bonds, though not as well as they do on average.

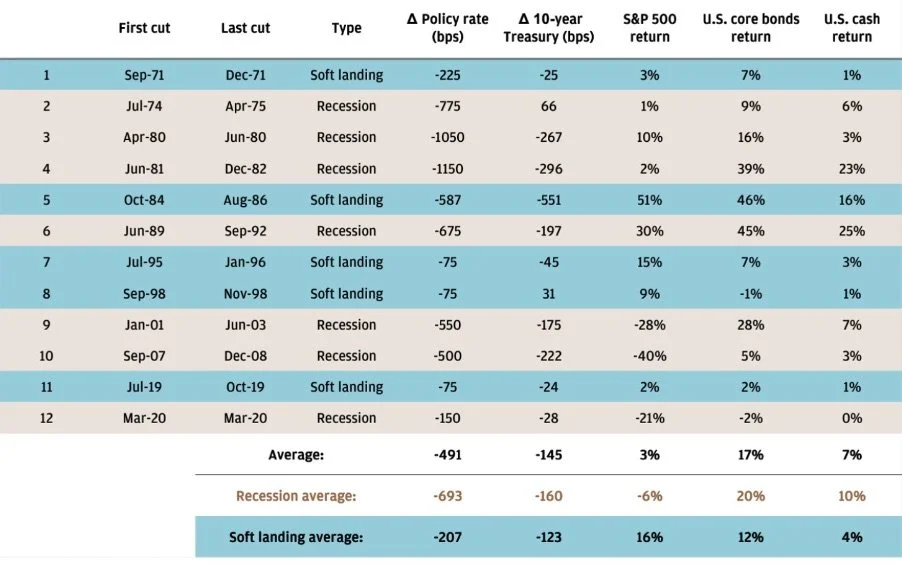

When we look at different inflation periods, we see that the best times for US stock returns have been when inflation is between 1-3%. Currently, inflation is at 2.5%, which is right in that sweet spot. If we continue to see growth, stable or falling inflation, and interest rate cuts, it would be an ideal situation for riskier investments like stocks. However, this describes a goldilocks situation, and these are rare. To look at the alternative we need more detail. Below we see each rate-cutting cycle going back to 1970 for the US categorised by whether the rate cuts coincided with a soft landing or a recession.

Source: Bloomberg Finance L.P., Haver Analytics, Ibbotson, from Tim Andres & Ben Bakkum, J.P. Morgan.

It’s interesting to note that when we look at data starting from 1970, the chances of a soft landing have been much higher— 42% compared to 27% when looking at data from 1928. In fact, out of the 6 soft landings recorded since 1928, 5 happened after 1970. However, during recessions since 1970, the average stock returns have been much lower, around - 6%. The performance range is quite broad, with stocks sometimes dropping as much as 40% or rising as much as 30% during recessions. Even in the best-case scenario where stocks gained 30%, bonds did even better with a 45% return, and cash returned 25%. If a recessionary scenario were to play out, you would want to be holding some bonds in your portfolio.

What does this mean for portfolios?

With this information, all we need to do now is accurately predict a soft landing or a recession and position accordingly, right? Unfortunately, it’s not that simple. Professional investors and academics often struggle to make accurate predictions. In fact, even if we had tomorrow’s financial news today, most people, including those trained in finance, would still lose money.

A fascinating study showed that young adults trained in finance were given the front page of the Wall Street Journal a day in advance and asked to trade stocks and bonds over a year. The results were surprising: about half of them lost money, and one in six went bankrupt. The main reasons for this poor performance were not accurately predicting market directions and making poor trade size decisions.

Our approach focuses on building well-diversified portfolios with strategic long-term asset allocations. This enables us to protect and grow wealth according to each investor’s risk profile irrespective of what the markets throw our way. We believe that this strategy provides the highest probability of success over time.

Q3 2024 Update & Fund Commentary

Our Quarterly Commentary aims to carry and share the bulk of our reflections and analysis of the previous quarter. To help cater to your preferences, we've provided various avenues for navigating through an entire Quarter's worth of news and data.

You can view the full recorded feedback session (± 1 hour 10 minutes) here for a deep dive into the last quarter

The presentation slides are also linked below

And for the real meat, scroll a little further to find the full detailed commentaries on both South African (35 pages) and Global markets (7 pages) and portfolios

To catch up on past insights, please visit our blog for a recap of previous commentaries.

And, of course, if you'd like to engage in further discussion, please don't hesitate to reach out. We're always here and ready to chat.

PortfolioMetrix Recorded feedback session

The PortfolioMetrix team has recorded their feedback session, discussing a few key aspects from this last quarter. We trust you'll enjoy and find this summarised commentary valuable.

The Quarterly Feedback Session & Presentation Slides are linked below:

For the full Local & Global Quarterly Fund Commentaries, please click the links below:

Local Fund Commentary

Provides a commentary on the past quarter, its events and their impacts; as well as more intimate commentary on each moving part within your portfolios.

Global Fund Commentary

Provides intimate commentary on each moving part within your global portfolios over the past quarter.

September 2024 Update

Global Update | Sept 2024

Provides an overview of current global market dynamics and essential insights.

Local Update | Sept 2024

Provides an overview of current local market dynamics and essential insights.

Performance Links

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog